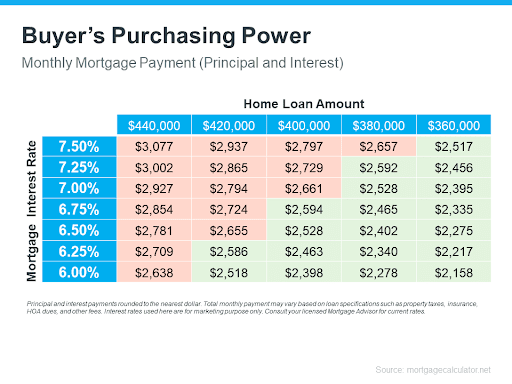

THE COST OF WAITING FOR MORTGAGE RATES TO GO DOWN

After a long stretch where buyers were competing for too few homes, inventory has made a comeback over the past year. And depending on where you live, that’s opening u… Read more

There’s a certain kind of buyer I’ve been working with a lot lately. They’re artists, designers, media professionals, tech creatives, musicians — people who care deep… Read more

After a couple of years where the housing market felt stuck in neutral, 2026 may be the year things shift back into gear. Expert forecasts show more people are expecte… Read more

The housing market hasn’t felt this energized in a long time – and the numbers backing that up are hard to ignore. Mortgage rates have eased almost a full percentage p… Read more

Even with small price declines in some markets, data shows you’re likely still way ahead. And that’s thanks to your home equity.

Essex County, New Jersey, has become the go-to destination for young families craving that sweet balance — city energy meets suburban ease.

With the Fall season comes an increase for tropical storms as well as heavy rain events in the North East. These heavy rains, storms, and floods can pose significant t… Read more

More homeowners are buying their next house outright, without taking on a new mortgage. And, if you’ve owned your home for a while, you may be able to do the same. No … Read more

Mortgage rates are finally heading in the right direction – and buyers are starting to jump back in.

Want to stay one step ahead of the market? Sign up to be on Dyanna's VIP mailing list to receive exclusive listings, real estate news and a lot more.