Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

If you’ve seen the news lately about home sellers slashing prices, it’s a great example of how headlines do more to terrify than clarify. Here’s what’s really happening with prices.

The bottom line is home prices are higher than they were a year ago at this time, and they’re expected to keep rising, just at a slower pace.

But a recent article from Redfin notes,

“Price Drops Hit Highest Level in 18 Months As High Rates Dampen Buyer Demand.”

And that might make you think prices are declining.

Now, while it’s true the latest report from Realtor.com also shows 16.6% of homes on the market had price reductions in May, which is up from 12.7% last May, that doesn’t mean overall home prices are falling.

The key is knowing the difference between the asking price and the sold price.

In essence, the asking price, also known as a listing price, is the amount a seller hopes to get for their home when they list it. In reality, sellers can’t just put any price tag on their house and expect it to sell for top dollar. Today’s buyers are savvy customers, and when they aren’t willing to pay a premium for a home because their budgets are strained by higher mortgage rates, sellers need to adjust. And that’s what’s happening right now.

Based on market factors and what offers that seller receives, that asking price can change. If a seller isn’t getting much foot traffic, you may see them revise the price and make an adjustment to reignite interest in the home – and sometimes that’s because they’ve overpriced it from the start. That’s where price reductions come in, and when you see “price drops” in a headline, it sounds like declining home prices.

Mike Simonsen, CEO and Founder of Altos Research, says:

“Not only is the share of homes with price cuts elevated compared to one year ago, but more price cuts are happening each week than last year.”

On the other hand, the final sold price is the amount a buyer actually pays when the transaction is complete.

Here’s the most important thing to note: Actual sold prices are still rising, and they’re expected to continue to do so at least over the next 5 years.

So, while there’s been an increase in price reductions recently, this doesn’t mean overall home values are declining. Instead, it’s a sign that demand is moderating. And, as a result, sellers are adjusting their expectations to align with today’s market reality.

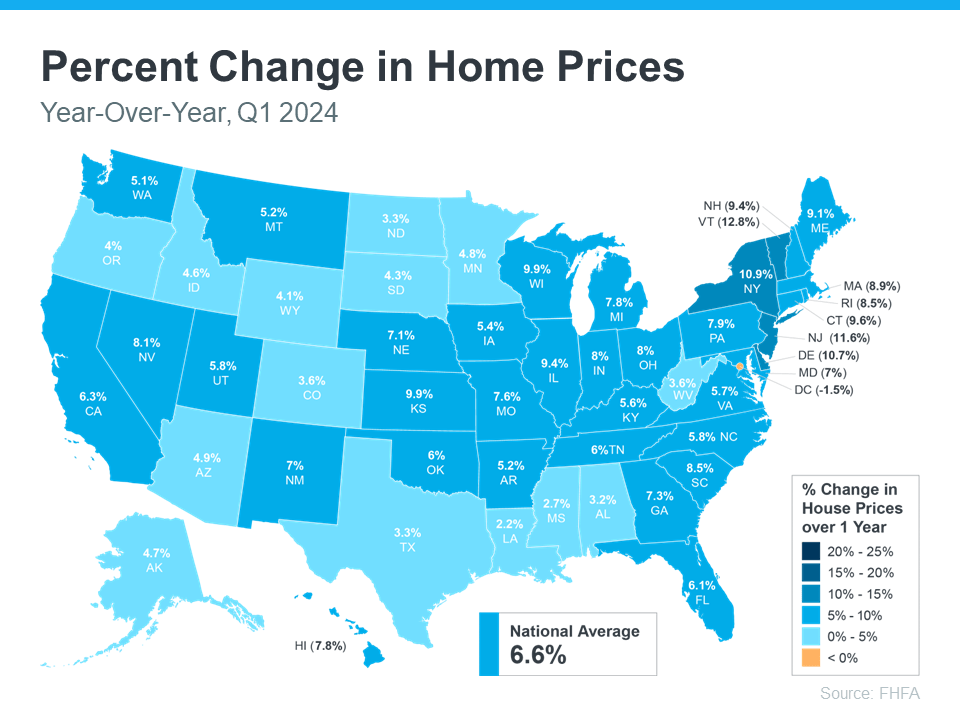

Even with more price reductions, home values are still growing on an annual basis, as they do nearly every year in the housing market. According to the Federal Housing Finance Agency (FHFA), home prices went up 6.6% over the last year (see below):

This map shows how prices rose just about everywhere in the country, indicating the market is not in decline.

So, while seller price reductions are often a leading indicator that prices may moderate in the months ahead, which experts have been saying for a while is expected to happen, they aren’t necessarily reason for alarm. The same article from Redfin also states:

“. . .those metrics suggest sale-price growth could soften in the coming months as persistently high mortgage rates turn off homebuyers. For now, the median-home sale price is up 4.3% year over year to another record high. . .”

And with inventory as tight as it is today, price moderation is much more likely in upcoming months than price declines.

For buyers, more realistic asking prices mean a better chance of securing a home at a fair price. It also means you can enter the market with more confidence, knowing prices are stabilizing rather than continuing to skyrocket.

For sellers, understanding the need to adjust your asking price can lead to faster sales and fewer price negotiations. Setting a realistic price from the start can attract more serious buyers and lead to smoother transactions.

While the uptick in price reductions might seem troubling, it’s not a cause for concern. It reflects a market adjusting to new conditions. Home prices are continuing to grow, just at a more moderate pace.

Courtesy of Keeping Current Matters

There’s a certain kind of buyer I’ve been working with a lot lately. They’re artists, designers, media professionals, tech creatives, musicians — people who care deep… Read more

After a couple of years where the housing market felt stuck in neutral, 2026 may be the year things shift back into gear. Expert forecasts show more people are expecte… Read more

The housing market hasn’t felt this energized in a long time – and the numbers backing that up are hard to ignore. Mortgage rates have eased almost a full percentage p… Read more

Even with small price declines in some markets, data shows you’re likely still way ahead. And that’s thanks to your home equity.

Essex County, New Jersey, has become the go-to destination for young families craving that sweet balance — city energy meets suburban ease.

With the Fall season comes an increase for tropical storms as well as heavy rain events in the North East. These heavy rains, storms, and floods can pose significant t… Read more

More homeowners are buying their next house outright, without taking on a new mortgage. And, if you’ve owned your home for a while, you may be able to do the same. No … Read more

Mortgage rates are finally heading in the right direction – and buyers are starting to jump back in.

Here’s the part most buyers don’t hear until it’s too late!

Want to stay one step ahead of the market? Sign up to be on Dyanna's VIP mailing list to receive exclusive listings, real estate news and a lot more.